working capital turnover ratio calculator

The Working Capital Turnover Ratio indicates how effective a company is at using its working capital. The higher the ratio the better.

Working Capital Turnover Ratio Formula Calculator Excel Template

The calculation would be sales of 320000 divided by average working capital of 22000 which equals a working capital turnover ratio of 145 times.

. A ratio of 2 is typically an indicator that the company can pay its current liabilities and still maintain its day-to-day operations. The formula to measure the working capital turnover ratio is as follows. In other words it displays the relationship between the funds used to finance the companys operations and the revenues the company generates as a result.

A higher ratio indicates higher operating efficiency where every dollar of working capital generates more revenue. The working capital turnover ratio reveals the connection between money used to finance business operations and the revenues a business produces as. Current Assets 10000 5000 25000 20000 60000.

The working capital turnover ratio shows the connection between the money used to finance business operations and. 500000 reserve surplus Rs. If Working Capital Turnover stays the same over time.

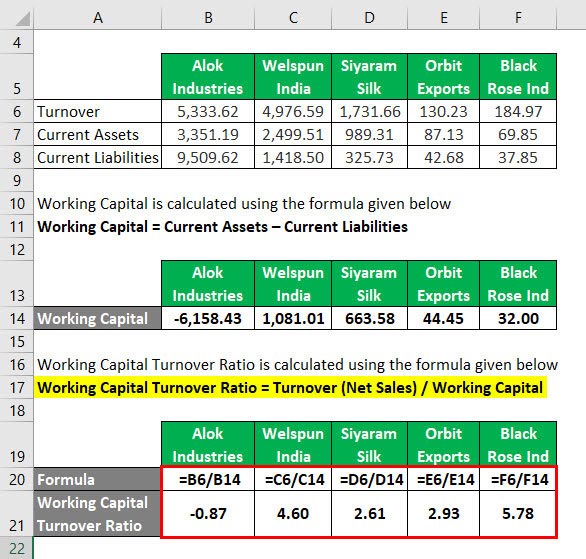

Working Capital Turnover Ratio is an efficiency ratio that measures the efficiency with which a company is using its working capital in order to support the sales and help in the growth of the business. Working capital is very essential for the business. It signifies that how well a company is generating its sales with respect to the working capital of the company.

Working capital turnover ratio is an analytical tool used to calculate the number of net sales generated from investing one dollar of working capital. Average Trade Payables Creditors in the beginning Bills payables in the beginning. Working Capital Turnover Ratio Formula.

Working Capital Turnover Ratio Cost of Sales Net Working Capital. High working capital turnover ratio is an indicator of efficient use of the companys short-term assets and liabilities to support sales. Apply Now Get Low Rates.

A higher working capital turnover ratio is better and indicates. Alison Free Online Learning - Fighting Education Inequality Worldwide. Ad Free Cash Capital Course Accredited By The Chartered Institute Of Management Accountants.

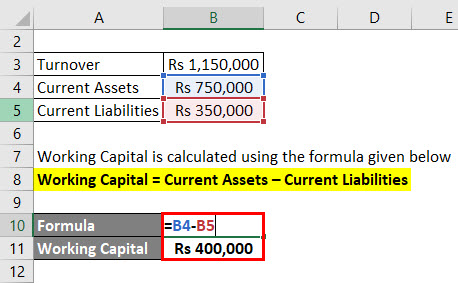

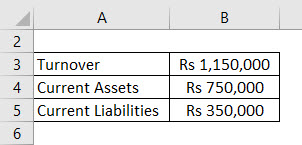

Working Capital Turnover Ratio. Working capital turnover Annual Revenue Average Working Capital. Net Working Capital Current assets Current liabilities.

Putting the values in the formula of working capital turnover ratio we get. Generally a higher ratio is better and suggests that the company does not require more funds. A decreasing Working Capital Turnover is usually a negative sign showing the company is less able to generate sales from its Working Capital.

Working Capital Turnover Ratio is calculated using the formula given below. An unchanged Working Capital Turnover may indicate the companys ability to generate sales from its Working Capital has remained the same. It measures how efficiently a business turns its working capital into increase sales.

From the following information calculate the working capital turnover ratio. The ratio is very. Discover a new framework to optimize working capital and digitize payments.

Working capital turnover is a ratio that quantifies the proportion of net sales to working capital and it measures how efficiently a business turns its working capital into increased sales numbers. That figure is higher for general construction businesses. The formula to determine the companys working capital turnover ratio is as follows.

Capital turnover is the measure that indicates an organizations efficiency about the utilization of capital employed in the business and it is calculated as a ratio of total annual turnover divided by the total amount of stockholders equity also known as net worth and the higher the ratio the better is the utilization of capital employed. Check out our trade and receivables financing options. ABC Company has 12000000 of net sales over the past twelve months and average working capital during that period of 2000000.

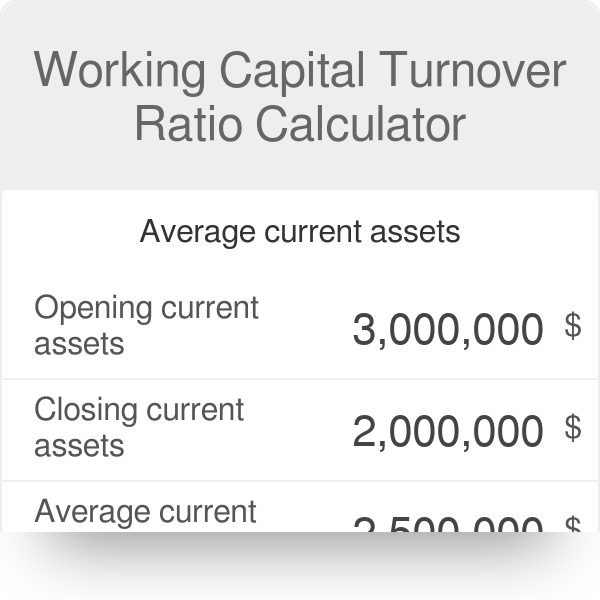

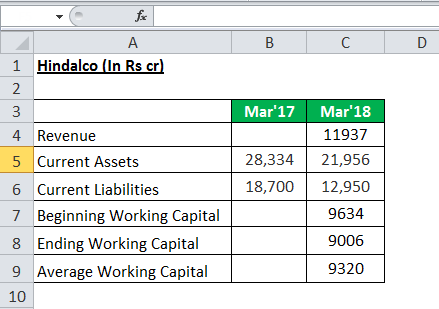

We calculate it by dividing revenue by the average working capital. Working capital turnover is a financial ratio to measure how efficiently companies use their working capital to generate revenue. The working capital turnover is a ratio to quantify the proportion of net sales to working capital.

Working Capital Turnover Ratio. Working capital can be calculated by subtracting the current assets from the current liabilities like so. Working Capital Turnover Ratio is a financial ratio which shows how efficiently a company is utilizing its working capital to generate revenue.

The Working Capital Turnover Ratio is also called Net Sales to Working Capital. Ad Compare Top 7 Working Capital Lenders of 2022. The calculation of its working capital turnover ratio is.

150000 divided by 75000 2. The working capital of a company is the difference between the current assets and current liabilities of a company. Current Liabilities 30000.

Calculate the working capital turnover ratio of a Company ABC Inc which has a net sales of 100000 over the past twelve months and the average working capital of the Company is 25000. Average working capital would be the average of 20000 and 24000. Similarly a lower ratio depicts poor management of short-term funds.

But an extreme higher ratio may also have drawbacks attached to it. A Liquidity Ratios 1. Ad Give your organization a new framework to optimize working capital and digitize payments.

What is the working capital turnover ratio for Year 3. The working capital turnover calculator helps in determining the efficient working of this by the management. 200000 and general reserve Rs.

For construction businesses working capital turnover typically falls somewhere between 3 and 7. Working capital turnover measures how effective a business is at generating sales for every dollar of working capital put to use. To arrive at the average working capital you can sum.

Working Capital Current Assets - Current Liabilities. Example of the Working Capital Turnover Ratio. Heres the formula to calculate a construction companys working capital turnover.

Iii Return on Investment. Ad HSBC Has a Range Of Solutions To Help You Self-Fund Growth Expand Your Business Reach. The formula for calculating this ratio is by dividing the sales of the.

WC Turnover Ratio Revenue Average Working Capital. This means that XYZ Companys working capital turnover ratio for the calendar year was 2.

Working Capital Turnover Ratio Meaning Formula Calculation

Efficiency Ratios Archives Double Entry Bookkeeping

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Calculator

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Efinancemanagement Com

Activity Ratio Formula And Turnover Efficiency Metrics

Working Capital Turnover Ratio Meaning Formula Calculation

Asset Turnover Ratio Formula Calculator Excel Template

How To Find Net Working Capital Formula

Working Capital Turnover Ratio Formula Calculator Excel Template

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Turnover Ratio Meaning Formula Calculation

Asset Turnover Ratio Formula And Excel Calculator

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Different Examples With Advantages